Benefit from AKGÜN privileges with the Finance Management System

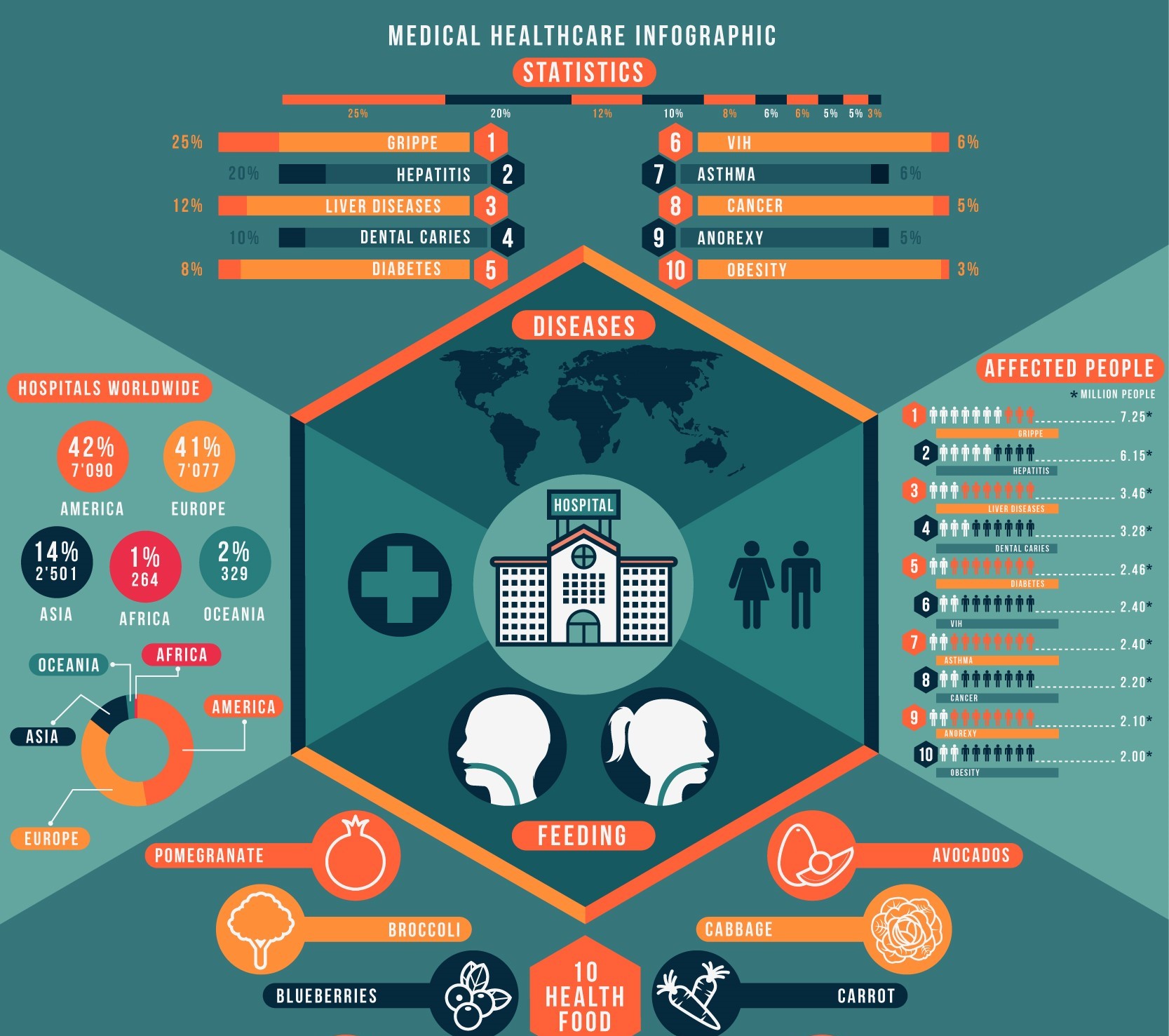

AKGUN Finance Management System facilitates organization wide monitoring and assessment of decision making functions, implementation of strategic financing methods in performance based budgeting in addition to operations for strengthening the Strategic Management capacity.

Thanks to its infrastructure design to allow monitoring and analysis of Account Transactions, efficiently monitoring operations to be executed by enterprises and taking necessary measures.

AKGUN FINANCE SOLUTIONS

Financial Management and Accounting Solutions Organizations, institutions and commercial enterprises can achieve success with their profitable work management competencies. In the competitive global environment, only a successful financial method can create new opportunities and competitive advantage for operations.

We offer a solution to manage complicated financial reporting, monitoring and corporate performance management etc. at the highest level independently from the sector. AKGUN Accounting and Financial Management solutions are ready to be your reliable partner.

Financial Management Solutions

AKGUN designed its global financial management solutions to automate and organize your financial businesses to create value:

Commercial receivables, payable accounts, general ledger, offset vouchers, consolidations and, cash management, pay roll, fixed asset and tax management, budgeting, estimations and planning.

Advanced Financial Transparency

Regulatory authorities and inspection companies agree on the necessity of advanced financial management of corporations.

Old systems are able to make reporting within their capacities, yet today, they have become unable to meet the needs of corporations due to the necessity of central financial information and transparency.

AKGUN financial management module is a solution to meet all your needs in terms of transparency irrespective of the size of your organization.

Global Financial Management Solutions

Successful companies grow in time. However, growing companies through organic expansion or mergers struggle with complicated operational management.

AKGUN offers a perspective on company basis with regard to management of multinational and global work divisions.

To meet concerned needs, AKGUN financial management system presents multiple company, multiple manufacturing facility and multiple warehouse operations and provides a powerful global financial management system.

Comprehensive Global Accounting Competencies for Growing Companies

AKGUN Financial Management module is based on foundation to offer efficient operations in current and prospective markets.

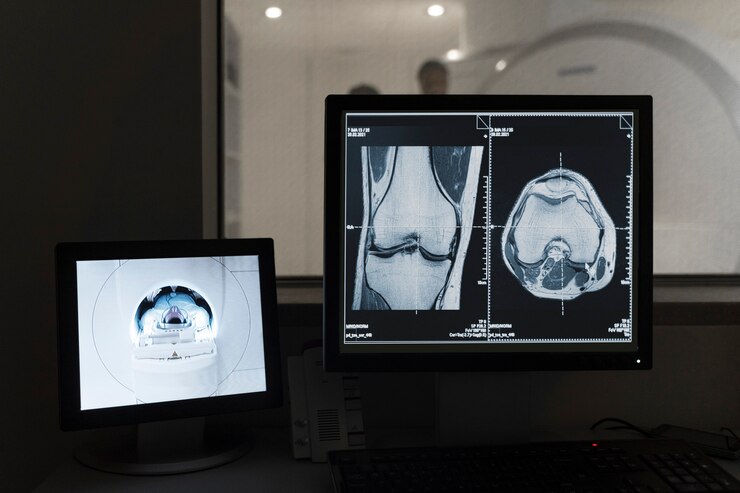

Account plans are created according to the Uniform Chart of Accounts by the Ministry of Finance and updated codes are continuously monitored. Users are able to easily monitor data on direct supply and bidding records. Records of the process monitoring system can be inquired retrospectively and company data can be obtained.

As reflection account codes are matched with expense account codes in payment transactions of companies, calculation and deductions can be made automatically over the recorded amount.

AKGUN HIS - Uniform Accounting Module generates easy to use and simplified solutions to the user;

1. Controls management of monetary values accrued from medical practices with accounting applications inside the administrative section.

2. All kinds of registry, wage and additional payment information of hospital employees are easily managed with the application.

3. Monetary management is controlled with the accounting applications integrated with warehouse, purchasing, teller and invoice modules.

4. Auxiliary accounts (Receivable/Payable, Deposit Accounts etc.) are monitored on organization/individual or invoice basis or collectively in the current system.

a) Payment time can be calculated for receivables.

b) Monthly and weekly debt payment lists can be created, financial debts can be monitored by their maturity dates and interest can be imposed on receivables.

c) Debts of companies to be written off can be recorded and monitored.

5. Payable and receivable balance control can be identified according to type of balance.

6. Payment documents ready for accrual are monitored and feedback of paid accrual documents can be automatically queried.

7. Invoices and processed collections are automatically turned into accounting vouchers at the end of the day and the accounting unit can monitor corporate balances.

8. Budget account can be monitored integrated with the accounting.

9. Revenue budget, estimated investments, expense budget

and analogy definitions are possible.

10. Users can add controls to budget accounts net of inflation monthly and annually if requested.

Detailed reports can be issued, finance management can be directed and timely measures can be taken. Including;

a. Bidding budget expense report

b. Budget expense reports (year, budget code)

c. Revenue budget balance (budget account code, accounting code, voucher date, type of procurement)

d. Expense statement (period revenue budget sheet, date range revenue budget sheet) (period budget sheet)

e. Date range budget sheet

f. Revenue sheet (period revenue sheet)

g. Financial tables (compared balance)

h. Budget compared balance

i. Income / expense statement

j. Budget compared revenue/expense table etc.

k. Reports on withholdings, VAT, stamp duty etc. tax liabilities

l. Company based delivery report forms

m. Breakdown options by the addressee and invoice numbers of transaction vouchers of accrual and bookkeeping etc.

Users are able to access applications depending on their level of authorization, data entry, update and reporting authorities are granted separately for each user group. These definitions can be changed by the system administrator when necessary.

The software ensures information confidentiality and security at user, transaction and information levels across the entire system. Passwords are used when necessary. Each user has a password and it is possible to change the password at any time.

Our aim is to control financial structure, increase revenues, support end user services and offer administrative results to administrators in desired period of time.